Table of Content

Allstate has a history of high customer satisfaction, but the digital era has exposed its flaws. It has a complaint rating of 2.73 on WalletHub, compared to State Farm’s score of 1.44. Other complaints include premium increases and a difficult claims process.

Typically, rural areas and cities with low population density have lower home insurance rates because rebuilding costs tend to be more affordable. Your child likely won't be able to be on your auto policy any longer because he or she doesn't live in your household. If you're the parent who isn't listing the child on your car insurance, your child can still drive your car and be covered by your insurance. Living near a full-time fire station with a nearby hydrant plays a role in your home insurance rates.

Farm and ranch insurance

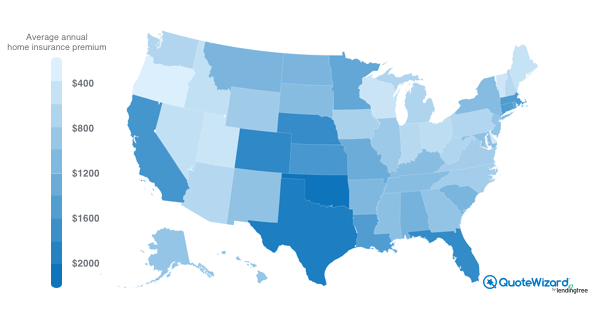

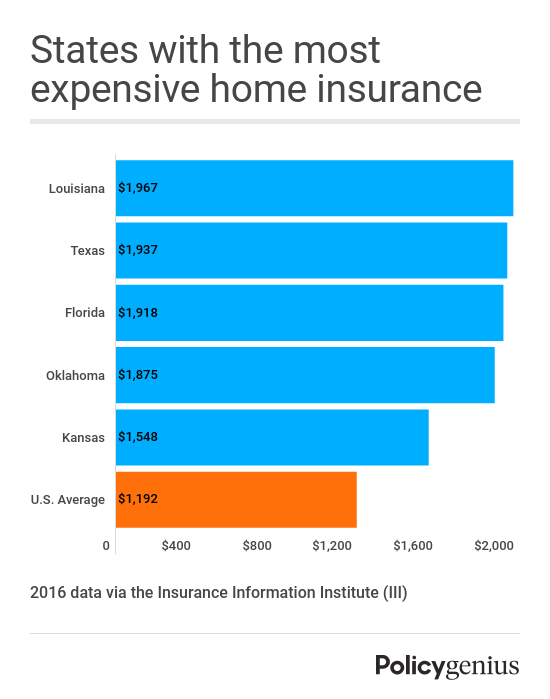

When we calculated the discount that each insurer offers customers who bundle auto and home coverage, the quotes from State Farm showed the greatest potential savings. It’s likely no surprise that many of the most expensive ZIP codes for home insurance are in states that experience lots of severe weather. The most expensive ZIPs in Louisiana, Mississippi, Alabama, Texas, and Florida are coastal areas prone to catastrophic storms. In states like Kansas and Oklahoma, tornadoes and other storms play a part. Naturally, the more claims paid out by insurers for damage due to wind, hail, and flooding, the higher home insurance rates will be for everyone.

You also choose a home insurance deductible amount, which applies to claims for damage to your home or belongings. Deductibles usually come in the amounts of $500, $1,000, $1,500, $2,000 and $2,500. Choose the amount you want to pay out-of-pocket before insurance kicks in. Oklahoma, Kansas, Nebraska, Arkansas, Texas and South Dakota are the most expensive states for home insurance among common coverage levels analyzed by Insurance.com.

Home and property insurance

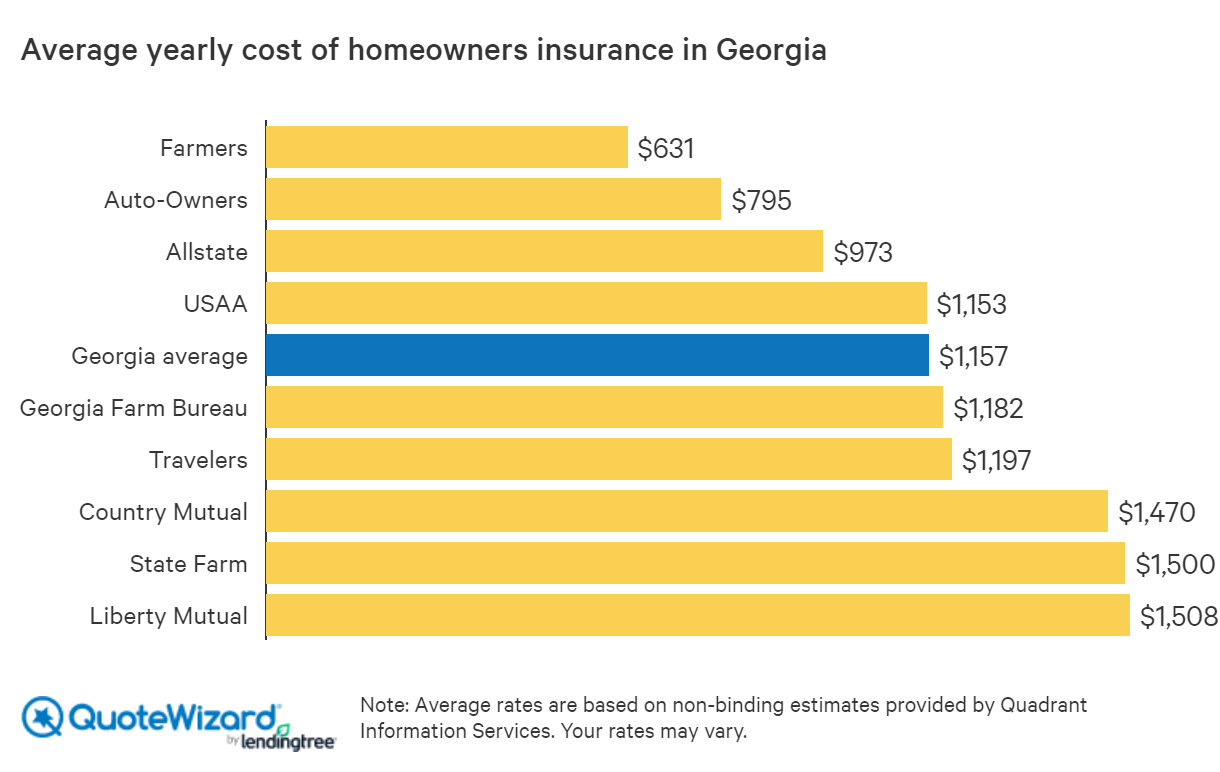

We found the cheapest insurance company in each state, along with its average monthly premium in that state. Allstate has the cheapest rates in 15 states — the most of any insurer in our study. Travelers has the best rates in eight states, while Nationwide offers the most affordable premiums in seven. USAA is the best low-cost homeowners insurance option for veterans and active service members and their families.

Both Allstate and State Farm offer bundles where you can combine your car, life, and home insurance at a lower rate than you’d pay separately. Allstate has better base discounts that more people can take advantage of, whereas State Farm discounts are largely focused on homeowners making improvements to their homes. Allstate is well-known today for offering numerous discounts to customers as well as high levels of coverage at a slightly higher price.

Step 4: Choose a deductible

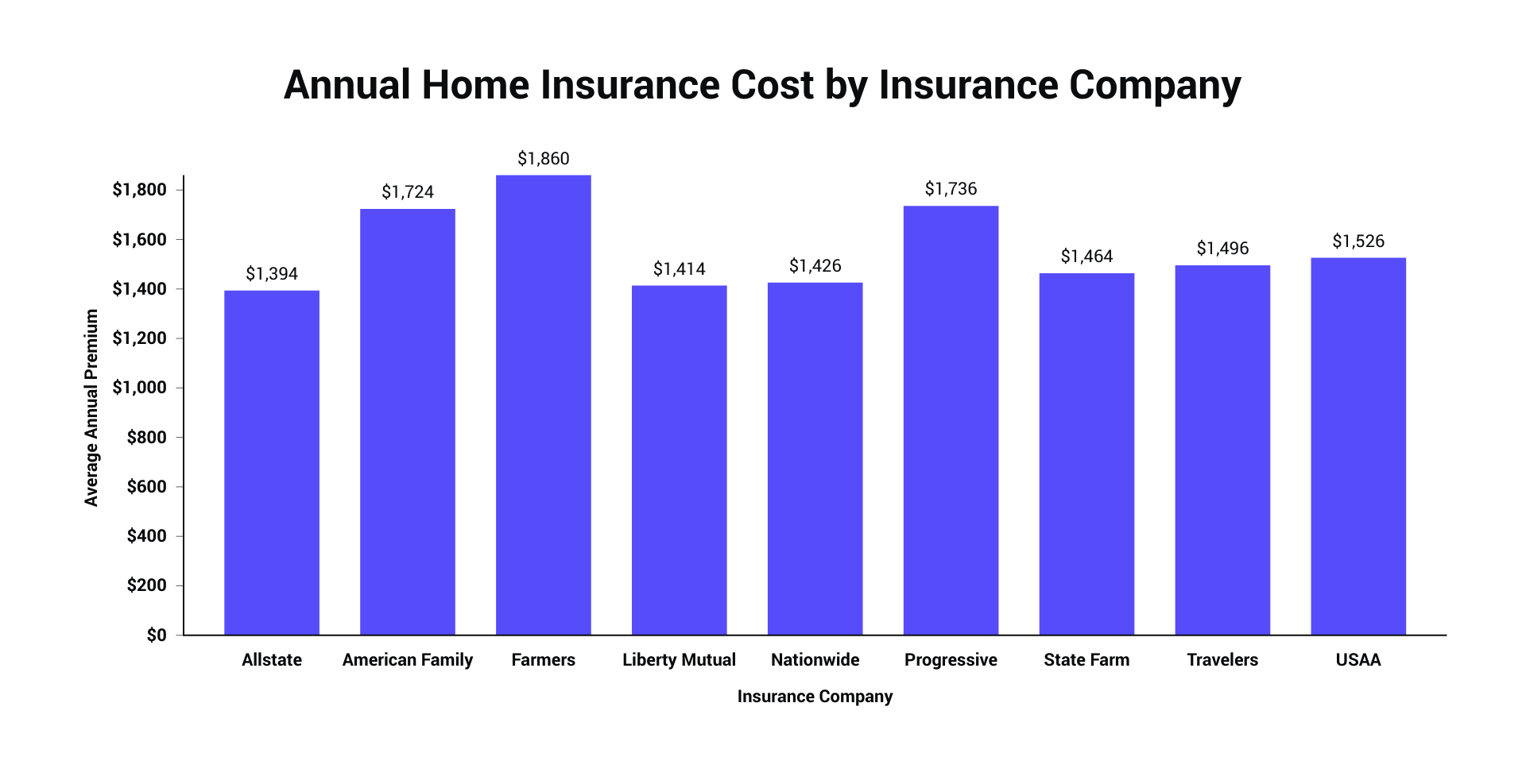

Insurance.com’s ranking provides an in-depth look at the best home insurance companies in 2022, based on a number of factors. Insurance.com ranked the major insurance companies for average price, J.D. Your dwelling coverage should equal the cost to repair damage to your home or rebuild it completely at equal quality — at current prices. Deductible on any of your insurance policies from State Farm can lower your premium. But if you decide to go this route, it’s important that you choose a deductible amount that you can still afford if you suddenly need to file a claim.

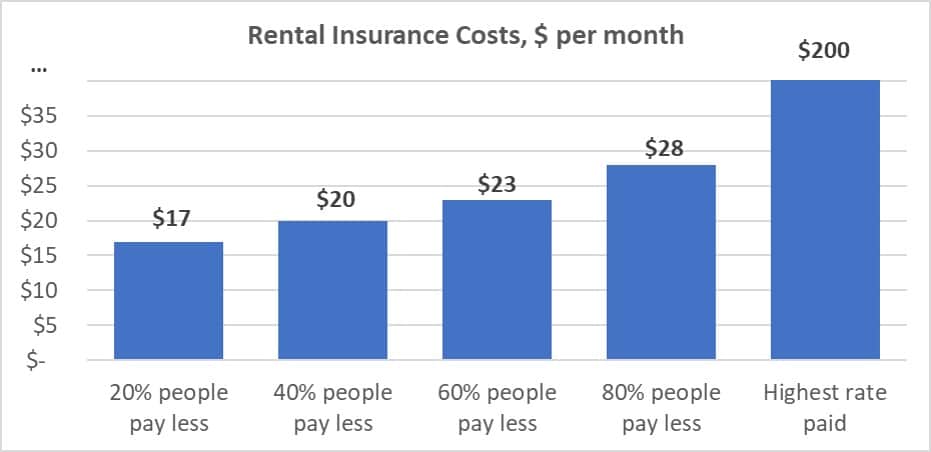

You can also use the home insurance calculator below to see what average rates are in your neighborhood. Remember you can lower your rate by making sure you receive all the home insurance discounts for which you qualify. For example, buying your home insurance from the same company that covers your cars, called bundling, can save you an average of 19%.

Brief History of Allstate

However, rates vary widely across the United States based on coverage, state laws, driving history, and other factors. In general, the more expensive your car is, the higher the amount of coverage you should purchase to ensure that all of your costs are taken care of in the event of an accident. Property Damage Liability Coverage (covers damage to other driver's vehicle or surrounding personal property). Bodily Injury Liability Coverage (covers other driver's medical costs after an accident). The average annual cost for a full-coverage policy was around $1,700 per year.

Personal liability also covers legal fees if you are sued, as well as any resulting judgments from a lawsuit, up to your policy limits. On the other hand, young drivers and drivers with a poor driving history will likely see the highest penalties on their State Farm insurance when they get a speeding ticket. This is because these drivers are already considered riskier to insure than drivers with more experience and a clean record. Drive Safe & Save, the State Farm telematics program, rewards you for good driving with a discounted premium. Specifically, Drive Safe & Save tracks miles driven, acceleration, braking, turns, speed, and distracted driving. By using Drive Safe & Save, drivers can save up to 50% on their rate.

State Farm offers a range of discounts that can lower the cost of your policy by hundreds – or even thousands – per year. At Insure.com, we are committed to providing honest and reliable information so that you can make the best financial decisions for you and your family. All of our content is written and reviewed by industry professionals and insurance experts.

Pick from four simple options if you need to file a home insurance claim. It might be a baseball card collection, camera equipment or fine art. Log into review billing history, update payment methods, and more.

Hawaii also holds on as the least expensive state for homeowners insurance in the country. Its average rates are an astounding 203% lower than the national average. When you opt for 12-month insurance, your rates are secured for a year. Your insurance rate can increase with a six-month policy, even if you didn't have any car accidents or receive any traffic violations during that time. Most insurers cover someone else driving the policyholder's car with their permission once in a while. But, if you're going to start driving one of your parent's cars regularly, you'll need to be added or named on their auto insurance.

Comparing homeowners insurance rates is the quickest path to cheaper rates. Choosing a higher deductible, making sure you get all the discounts that you can and not filing too many claims can also ensure you get the cheapest home insurance. Choosing State Farm for your homeowners insurance offers other advantages besides competitive discounts. Not only is it the largest insurer for American homeowners, but it also received a score of 835 out of 1,000 from J.D. This means that State Farm is also one of the top choices for anyone who values excellent customer service from their home insurance company.

How much is homeowners insurance per month?

No, you cannot negotiate car insurance rates because the industry and prices are heavily regulated by each state. Although you can't negotiate insurance rates, you can strategically negotiate the insurance shopping experience to get the lowest price possible for the coverage you need. And — spoiler alert — that $100 monthly premium doesn’t include the special savings you get for bundling your State Farm auto and homeowners policies. For now, here’s a breakdown of what’s standard and what’s à la carte with your State Farm home insurance policy. We generally urge shoppers to get quotes from at least three companies, if not more, before purchasing a policy. Insurance policies can vary by thousands of dollars, so comparing rates is the best way to ensure you're getting a solid deal.